We’ve Only Just Begun: What the Data Signals for the Next Era of Global Business Services

Posted by Naomi Secor on January 15, 2026

January is not about reflection. It's about direction.

Every year, SSON Research & Analytics publishes the State of the Shared Services & Outsourcing Industry with one responsibility in mind: to give this community a clearer line of sight into what is actually changing, not what is being marketed as new.

The 2026 data confirms something important. Shared services and GBS are no longer trying to prove relevance. That question is settled. The real work now is about how value is created, measured, and sustained across the enterprise.

If you are leading a GBS or shared services organization today, here are five things to think about right now, based directly on what nearly 500 executives told us.

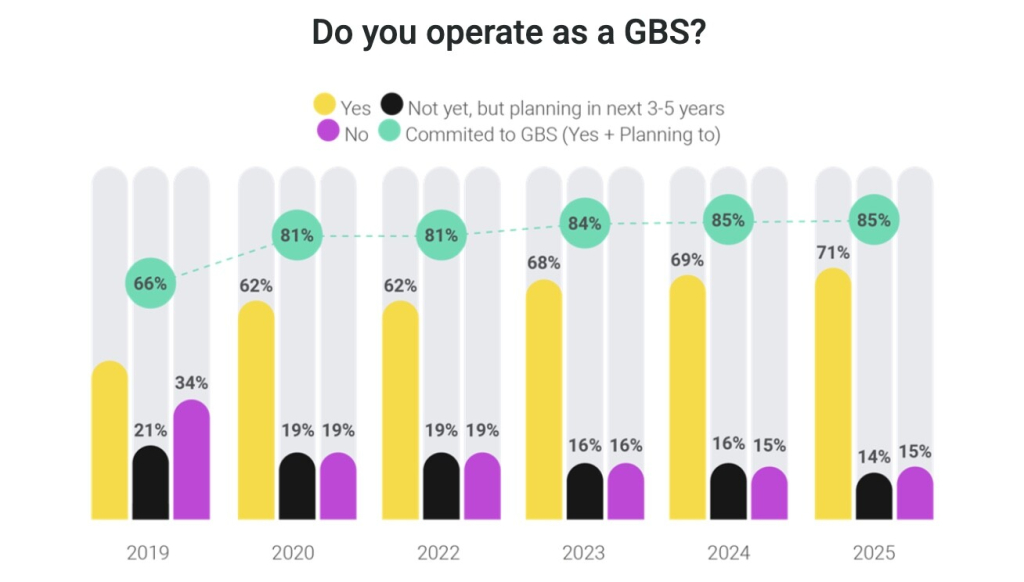

1. GBS Is No Longer a Model Choice. It Is the Default Operating Reality

85% of organizations are either operating as a GBS today or actively committed to becoming one. The question of whether GBS "works" has been answered by the market.

What matters now is what this level of adoption implies. Most organizations are already multi-function, multi-country, and operating at scale. Many are running four or more centers globally, often by design rather than accident.

This is a clear maturity signal. GBS is no longer being optimized for efficiency alone. It is being positioned to balance talent access, risk diversification, regional enablement, and responsiveness to the business.

The leaders who are pulling ahead are not asking how to shrink the model. They are asking how to govern it intelligently.

As Vanessa Gleason, Global Head of Takeda Business Solutions, puts it, the industry sometimes gets too focused on what GBS should look like, rather than what the company actually needs at a given point in its business cycle. The leaders who succeed are those willing to design what is “best for the company,” not “best in the shared services world.”

SSON Research & Analytics' 2026 State of Shared Services & Outsourcing Study

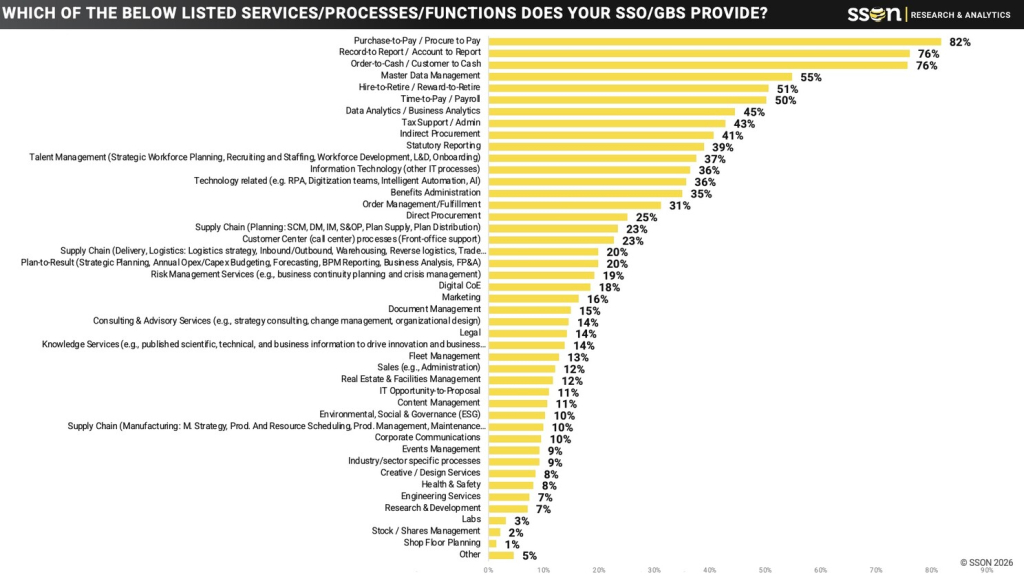

2. GBS Has Become a Different Business Inside the Business

45% of GBS organizations now provide data analytics or business analytics services, and 55% manage enterprise master data. This is where the shift becomes unmistakable.

GBS is no longer defined by a narrow set of back-office processes. The scope now extends deep into analytics, supply chain, advisory, marketing, and even sales support. These are services that directly influence decision-making, performance, and growth.

What this tells us is not that GBS is doing more.

It is doing something fundamentally different.

Suzanne Leopoldi-Nichols, former Head of GBS at WPP and UPS, describes this shift as the move from delivering services to delivering decisions, where GBS evolves into an intelligence-driven operating system that blurs traditional front, middle, and back-office boundaries.

The implication for leaders is significant. Managing analytics, insights, and advisory work requires a very different operating rhythm than transactional processing. It demands stronger business alignment, sharper talent profiles, and a clearer articulation of value.

Organizations that still describe their GBS primarily in functional terms are underselling what it has already become.

SSON Research & Analytics' 2026 State of Shared Services & Outsourcing Study

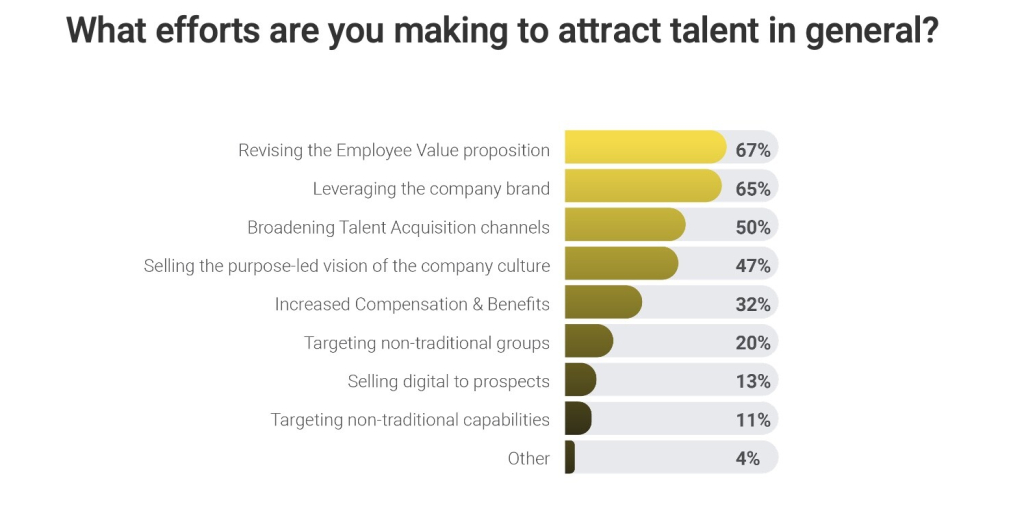

3. Talent Strategy Is Now a Leadership Strategy

67% of organizations are actively revising their Employee Value Proposition (EVP) to attract and retain talent.

Hybrid work is now the dominant model, and the data shows that fears around declining performance have largely not materialized. Many organizations report improved output and stronger skill alignment through regional and global hiring.

What has changed most is what people expect from GBS roles. Career progression, exposure to digital initiatives, learning opportunities, and purpose now consistently outweigh location alone. This is especially true for Gen Z, where retention improves meaningfully when development pathways are visible and credible.

The strongest GBS organizations are not just filling roles. They are intentionally curating experiences that signal long-term relevance.

SSON Research & Analytics' 2026 State of Shared Services & Outsourcing Study

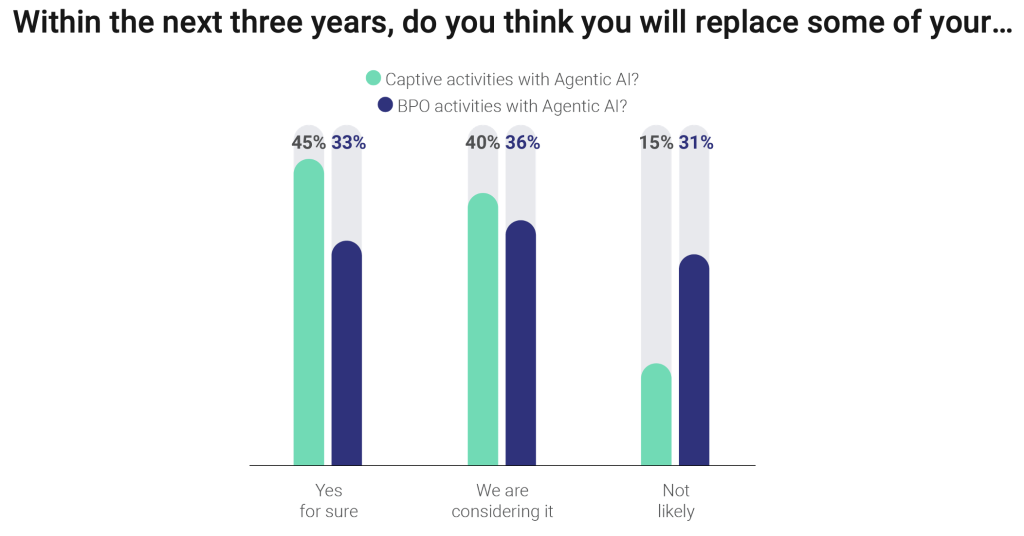

4. Agentic AI Will Redesign Work, Not Eliminate Responsibility

45% of respondents believe they will replace some captive activities with Agentic AI within the next three years.

Agentic AI is no longer theoretical in GBS. Expectations are real, particularly within captive environments where leaders retain control over implementation and governance.

At the same time, the data shows restraint. Leaders are not expecting full autonomy. They are expecting a redistribution of work. Humans remain central to orchestration, exception management, risk oversight, and accountability.

Reflecting on three decades of shared services evolution, Barbara Hodge, Global Editor at SSON Research & Analytics, notes that while transactions can increasingly run through machines, GBS’s full potential has never been unlocked by technology alone. It requires bold leadership, future-focused conversations, and human judgment at the helm.

The real takeaway is this: Agentic AI rewards organizations that understand their processes end to end. It exposes fragmentation quickly. Technology is accelerating outcomes, but only where foundations are solid. This is not a technology race. It is an operating discipline test.

SSON Research & Analytics' 2026 State of Shared Services & Outsourcing Study

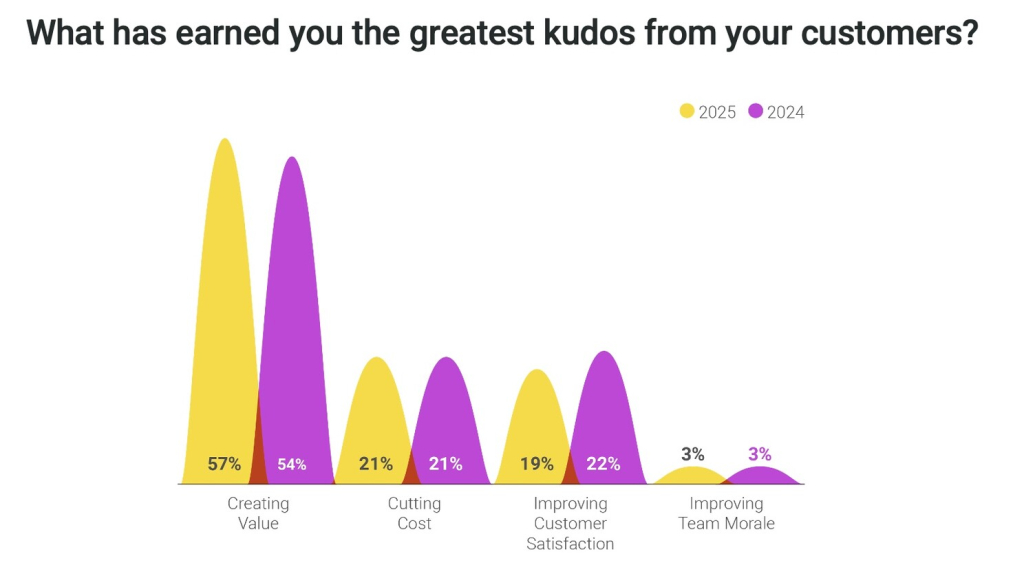

5. Customers Are Rewarding Value, Not Activity

57% of GBS leaders say creating value earns them the greatest recognition from customers, compared to just 21% for cost reduction

Efficiency is no longer what earns credibility. It is assumed.

What customers recognize and reward is impact. That includes growth enablement, margin improvement, risk mitigation, and capability building.

This helps explain why nearly 80% of organizations plan to expand their scope further in the year ahead. GBS is increasingly viewed as a partner in enterprise outcomes, not a service provider measured solely by throughput.

The organizations that win here are those that can clearly connect what they do to what the business values most.

SSON Research & Analytics' 2026 State of Shared Services & Outsourcing Study

Direction Is the Advantage

As Dr. Sumit Mitra, CEO of Tesco Business Solutions & OmniSol, observes, shared services has evolved from a cost-arbitrage strategy into a platform for capability creation, blending technology, data, design, and human judgment to drive enterprise value in ways early pioneers could never have imagined.

The 2026 State of the Industry data does not point to a single blueprint. It points to a responsibility.

GBS has earned its seat at the table. With that comes higher expectations, sharper questions, and greater opportunity to shape enterprise performance in meaningful ways.

If you want to explore the full findings, you can download the 2026 State of the Shared Services & Outsourcing Industry Report.

If you want to hear how we are interpreting these findings live, join us for our State of Industry Highlights Webinar next week on Tuesday, January 20th where we will go deeper into what this means for operating models, talent strategies, and technology investment.

And if you are looking for ongoing access to the benchmarks, location intelligence, technology landscape insights, cutting-edge research, and GBS Advisory support from world-class practitioners, that is exactly what SSON Research & Analytics is built to support. We would love to hear what you are working on and show you how others are using the data to move faster and with more confidence.

We’ve only just begun. What matters now is where you take it next.

Until Next Time,

Naomi Secor, Global Managing Director, SSON Research & Analytics